The Tampon Tax Crisis

Throughout history, women have been held back on a variety of topics. They have been suppressed because of their age, sexual orientation, opinions and more. They have even been restricted by society about one of the most natural occurrences there is—their menstrual cycle.

Society has implanted the idea that talking about your period is unladylike, considered “gross” or “disgusting” and, ultimately, should be kept private. But this is 2017 and it is safe to announce that all women have periods; we bleed, and we can not help that.

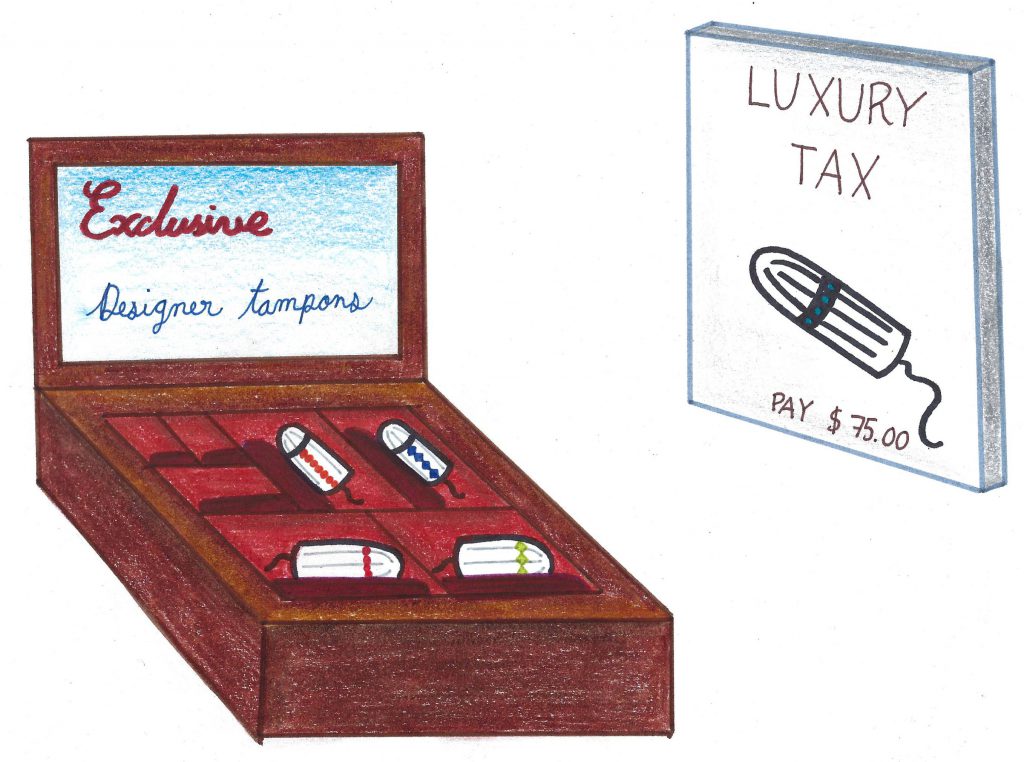

Now that the air has been cleared, we can get to the real issue: the tampon tax crisis. The name is funny, but the reality is not. To those who are unaware of the tampon tax crisis, it refers to the luxury taxes that have been placed on sanitary pads and tampons in the United States.

Luxury taxes are additional taxes placed on certain items not considered essential, such as games and jewelry. Items that are basic human necessity, toilet paper for example, do not contain a luxury tax. That makes sense because everyone needs toilet paper and it would be unfair to have to pay extra costs for it.

Sanitary pads, tampons and other feminine hygiene items considered essential are not exempt from luxury tax, and it is unacceptable. Periods are natural. They can not be stopped and women should not be taxed for something that they can not control. It is unfair and cruel to tax periods.

Why is it that other hygiene products such as shaving cream, body wash and soap are exempted from luxury tax but tampons are not? They are equally important and serve a similar purpose.

Women all over the world began to protest about the tampon tax. On Twitter, women also began to make jokes about the situation using the hashtag #tampontax.

Attempts to solve the issue have been made. In May, Florida Governor Rick Scott approved a bill that makes feminine hygiene products such as tampons and menstrual pads tax-exempt starting in January.

Florida, along with 13 other states and the District of Columbia, has either exempted taxes on the sale of feminine hygiene products or enacted laws to exempt these products in the future.

According to the Tax Foundation, located in Maryland and Massachusetts, feminine hygiene products are exempt because they are considered medical products. Pennsylvania exempts toilet paper, sanitary napkins, tampons or similar items used for feminine hygiene.

This marks a step forward in the United States, but it is not enough. The rest of the world still has a luxury tax on feminine hygiene products and it is not fair. If items such as razors, shaving cream and condoms are not taxed, tampons should not be taxed either.